Personal loans are a versatile financial tool that can help you manage a variety of financial needs, from consolidating debt to funding a major purchase. This guide aims to walk you through everything you need to know about personal loans—what they are, the types available, factors to consider when applying, and much more. By the end, you’ll be well-equipped to make informed decisions that align with your financial goals.

Toc

Introduction of Personal Loans and Why it is important today

What is a Personal Loan?

A personal loan is a type of unsecured loan provided by financial institutions, such as banks, credit unions, or online lenders, that can be used for virtually any purpose. Unlike mortgages or auto loans, personal loans do not require collateral. This means you don’t have to put up any assets, like your home or car, as security for the loan. Instead, the lender relies on your creditworthiness and ability to repay to determine your eligibility. The amount you can borrow, the interest rate, and the repayment terms will vary based on several factors, including your credit score, income, and debt-to-income ratio.

Types of Personal Loans

There are several types of personal loans available, each designed to meet specific financial needs.

- Fixed-Rate Loans: These loans come with an interest rate that remains constant throughout the term of the loan, ensuring consistent monthly payments.

- Variable-Rate Loans: In contrast, these loans have an interest rate that can fluctuate based on market conditions, which can result in varying monthly payments.

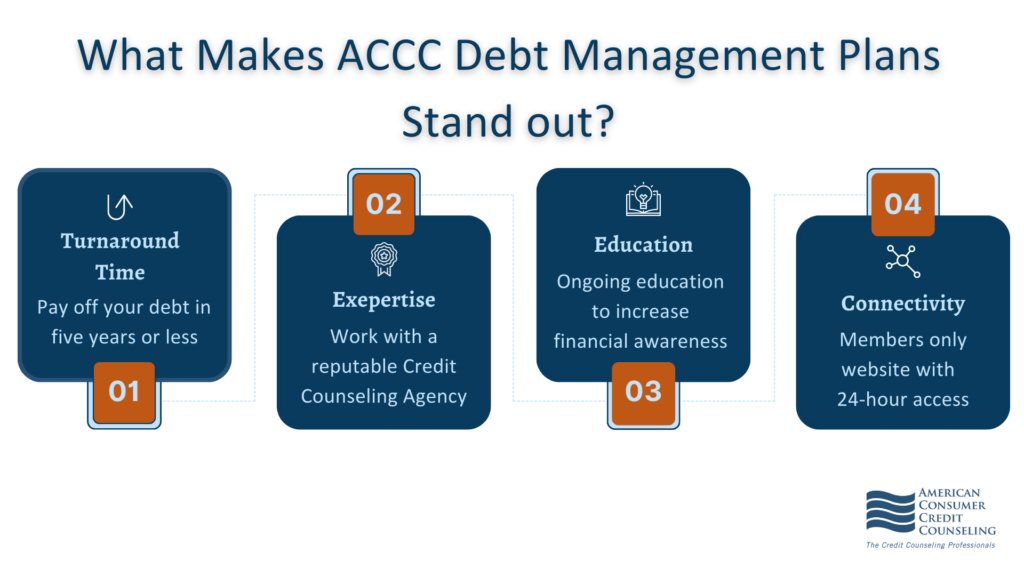

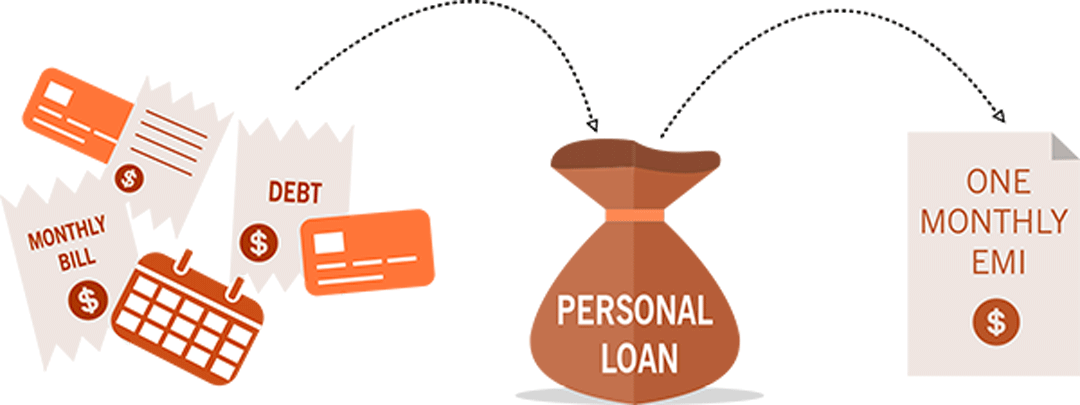

- Debt Consolidation Loans: These are specifically designed to consolidate multiple debts into a single loan with one monthly payment, often at a lower interest rate.

- Cosigned Loans: If you have difficulty qualifying for a loan on your own, a cosigned loan allows you to add a cosigner with better credit, thereby increasing your chances of approval and potentially securing a lower interest rate.

Understanding the different types of personal loans available can help you choose the right option for your specific financial situation.

Why Personal Loans are Important Today

Personal loans have become increasingly popular in recent years, and for good reason. Here’s why they’re important today:

- Flexibility: As mentioned earlier, personal loans can be used for a variety of purposes, from consolidating debt to funding a home renovation or covering unexpected expenses.

- No Collateral Required: Unlike secured loans, such as mortgages or auto loans, personal loans do not require collateral. This makes them accessible to individuals who may not have significant assets to put up as security.

- Lower Interest Rates than Credit Cards: If you have high-interest credit card debt, a personal loan can help you consolidate and pay off the debt at a lower interest rate.

- Improve Credit Score: When used responsibly, taking out a personal loan and making timely payments can help improve your credit score over time.

- Fast Approval Process: Compared to other types of loans, personal loans have a relatively quick approval process, allowing you to access funds when you need them most.

Factors to Consider When Applying to personal loans

When considering a personal loan, there are several factors you should keep in mind to ensure you make informed decisions:

Credit Scores

Your credit score is one of the most critical factors that lenders consider when evaluating your personal loan application. A higher credit score indicates that you are a reliable borrower, which can help you secure more favorable terms, such as lower interest rates and higher loan amounts. Generally, a credit score above 700 is considered good, while scores above 800 are excellent. If your credit score is lower, you may still qualify for a loan, but you might face higher interest rates or less favorable terms. Checking your credit score beforehand and taking steps to improve it, such as paying down existing debts and making all payments on time, can increase your chances of approval.

Income and Employment Status

Lenders will also look at your income and employment status to assess your ability to repay the loan. A stable income and steady employment can significantly boost your chances of getting approved. Some lenders may require proof of income, such as pay stubs, tax returns, or bank statements. If you are self-employed or have multiple income streams, be prepared to provide additional documentation to verify your income.

Debt-to-Income Ratio

Your debt-to-income (DTI) ratio is another important factor that lenders evaluate. This ratio compares your monthly debt payments to your monthly gross income. A lower DTI ratio indicates that you have a manageable level of debt relative to your income, which can make you a more attractive candidate for a loan. Lenders generally prefer a DTI ratio of 36% or lower, but some may go up to 45%, depending on other aspects of your financial profile.

Loan Amount and Term

When applying for a personal loan, consider how much money you need and how long you will need to repay it. The loan amount and term you choose will affect your monthly payments and the total cost of the loan. Borrowing only what you need and choosing a term that fits your budget can help you manage your repayments more effectively.

Interest Rates and Fees

Interest rates on personal loans can vary widely based on your creditworthiness, loan amount, and term. It’s essential to shop around and compare rates from different lenders to find the best deal. Additionally, be aware of any fees associated with the loan, such as origination fees, prepayment penalties, or late fees. These fees can add to the overall cost of the loan, so factor them into your decision-making process.

Repayment Terms

Understanding the repayment terms of the personal loan is crucial to ensure that the monthly payments fit within your budget. Fixed-rate loans offer predictability with consistent monthly payments, while variable-rate loans can fluctuate, potentially making budgeting more challenging. Make sure to review the loan agreement carefully and understand the payment schedule, due dates, and any consequences for missed or late payments.

Lender Reputation

Finally, consider the reputation and reliability of the lender. Look for reviews and ratings from other borrowers to gauge their experiences. Ensure that the lender is transparent about their terms and conditions and has a customer service team that can assist you with any questions or concerns throughout the loan process. Reputable lenders will have clear terms, straightforward processes, and positive feedback from their clients.

Taking these factors into account can help you choose the right personal loan for your needs and ensure that you are well-prepared for the application process.

The Application Process for Personal Loans

The specific application process may vary slightly from lender to lender, but the general steps are as follows:

Step-by-Step Guide

- Check Your Credit Score: Before applying, know your credit score to understand your eligibility.

- Research Lenders: Compare offers from various lenders to find the best terms.

- Gather Documentation: Commonly required documents include proof of income, identification, and proof of residence.

- Submit Application: Fill out the lender’s application form and submit the required documents.

- Approval and Funding: Upon approval, the funds are usually disbursed within a few days. Be sure to review and sign the loan agreement carefully before accepting the funds.

- Repay Loan: Make timely payments according to the agreed-upon schedule until the loan is fully repaid.

Eligibility Criteria

- Minimum credit score

- Proof of stable income

- Debt-to-income ratio

- Age and residency requirements

- Valid identification and proof of address

- Other specific requirements may vary by lender

Tips for a Successful Application

- Check Your Credit Report: Ensure that your credit report is accurate and dispute any errors.

- Improve Your Credit Score: Take steps to improve your credit score before applying, such as paying down debts or correcting any negative factors.

- Compare Offers: Don’t settle for the first offer you receive; instead, compare rates and terms from multiple lenders to find the best deal.

- Have Required Documents Ready: Gather all necessary documents beforehand to avoid delays in the application process.

- Be Honest: Provide accurate and truthful information on your application to avoid potential issues down the line.

- Ask Questions: If you have any questions or concerns, don’t hesitate to reach out to the lender for clarification.

- Review the Fine Print: Carefully review all terms and conditions before accepting funds to ensure that you understand all aspects of the loan agreement.

- Make Timely Payments: Make sure to make timely payments according to the agreed-upon schedule to avoid penalties and maintain a good credit standing.

Alternatives to Personal Loans

Before committing to a personal loan, it’s worth considering alternative financing options that might suit your needs better. Here are a few alternatives to explore:

Credit Cards

For smaller expenses or short-term financing, a credit card might be a more flexible option. With many cards offering interest-free periods and rewards programs, you could find it more convenient to use a credit card for certain expenditures. However, be cautious of high-interest rates and potential fees if the balance isn’t paid off within the interest-free period.

Home Equity Loans or Lines of Credit (HELOC)

If you own a home, a home equity loan or line of credit (HELOC) can be a cost-effective way to borrow larger sums of money. These loans typically offer lower interest rates compared to personal loans since they are secured by your property. However, it’s important to remember that failing to repay these loans could result in the loss of your home.

Borrowing from Family or Friends

In some cases, borrowing from family or friends can be an option worth considering. This route often provides more flexible repayment terms and potentially lower or no interest. However, it’s essential to approach these arrangements with clear terms and mutual agreement to prevent any potential strain on relationships.

Peer-to-Peer Lending

Peer-to-peer lending platforms match borrowers with individual lenders willing to fund their loans. Often, these platforms can provide competitive rates and terms. However, like any financial agreement, it’s important to review the terms carefully and ensure the lending platform is reputable.

Personal Savings

If you have personal savings or an emergency fund, using these funds might be the best way to finance your expenses without incurring debt. While it might be tough to dip into your savings, it could save you from paying interest and fees associated with loans or credit cards. Always weigh the pros and cons before deciding to use your savings for expenses, especially if the funds are earmarked for emergencies.

Conclusion

In conclusion, personal loans can be an effective financial tool when used responsibly. By understanding the application process, eligibility criteria, and tips for a successful application, you can increase your chances of securing a favorable loan. It’s crucial to consider the impact on your credit score and financial health, as well as exploring alternative financing options. By making informed decisions and managing your debt wisely, you can leverage personal loans to meet your financial goals without compromising your long-term financial stability. So, it’s always advisable to do thorough research and carefully consider all factors before taking out a personal loan. With the right approach, a personal loan can help you achieve your financial goals and improve your overall financial well-being. So, it’s always advisable to do thorough research and carefully consider all factors before taking out a personal loan. With the right approach, a personal loan can help you achieve your financial goals and improve your overall financial health.