Managing debt can feel overwhelming, but a debt management program may be the solution you’ve been searching for. Designed to consolidate multiple debts into a single, manageable monthly payment, these programs offer professional financial guidance and a clear path towards becoming debt-free. Let’s explore how debt management programs can help you regain control of your finances.

Toc [Hide]

- 1. Understanding the Need for Debt Management Programs

- 2. Key Benefits of Debt Management Programs

- 3. How Debt Management Programs Work – The Process Explained

- 4. Steps to Enroll in a Debt Management Program

- 5. Success Stories – Real People, Real Results

- 6. Conclusion – Taking the First Step Towards Financial Freedom

Understanding the Need for Debt Management Programs

![]()

Debt can accumulate quickly, whether it’s through credit cards, medical bills, student loans, or other forms of borrowing. When you’re juggling multiple payments with varying interest rates and due dates, it’s easy to feel like you’re sinking in quicksand. A debt management program offers a structured way to handle your debt, reducing stress and providing a roadmap to financial stability. But first, let’s discuss the signs that indicate you may need help managing your debt.

Signs You May Need a Debt Management Program:

- Struggling to make minimum payments

- Falling behind on bills

- Constantly receiving calls from creditors or collection agencies

- Using credit cards to pay for daily expenses

- Feeling overwhelmed by debt

If any of these scenarios sound familiar, it may be time to consider a debt management program. These programs are designed specifically for individuals who are struggling with their debts and want professional guidance in getting back on track.

How Does a Debt Management Program Work?

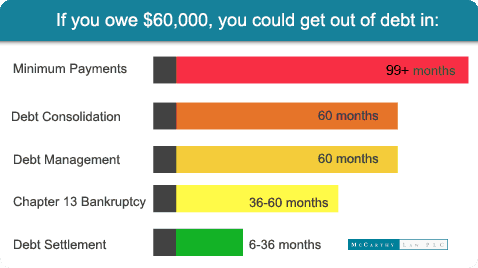

Debt management programs work by consolidating your debts into one monthly payment. This is done through a debt management company, which negotiates with your creditors to lower interest rates and waive fees. Then, you make one monthly payment to the debt management company, who distributes the funds to your creditors. This not only simplifies your payments, but can also save you money in the long run by reducing interest and fees.

Key Benefits of Debt Management Programs

In addition to simplifying your payments and potentially saving you money, debt management programs offer several other benefits. These include:

Consolidation of Multiple Debts

With a debt management program, you no longer have to keep track of multiple due dates. Instead, you make one consolidated payment, making it easier to manage your finances.

Lower Interest Rates and Waived Fees

One of the significant advantages of enrolling in a debt management program is the possibility of lower interest rates and waived fees. Debt management companies negotiate with creditors on your behalf to reduce interest rates, which can substantially decrease the total amount you owe. Additionally, creditors may agree to waive certain fees, such as late payment fees, which further eases your financial burden.

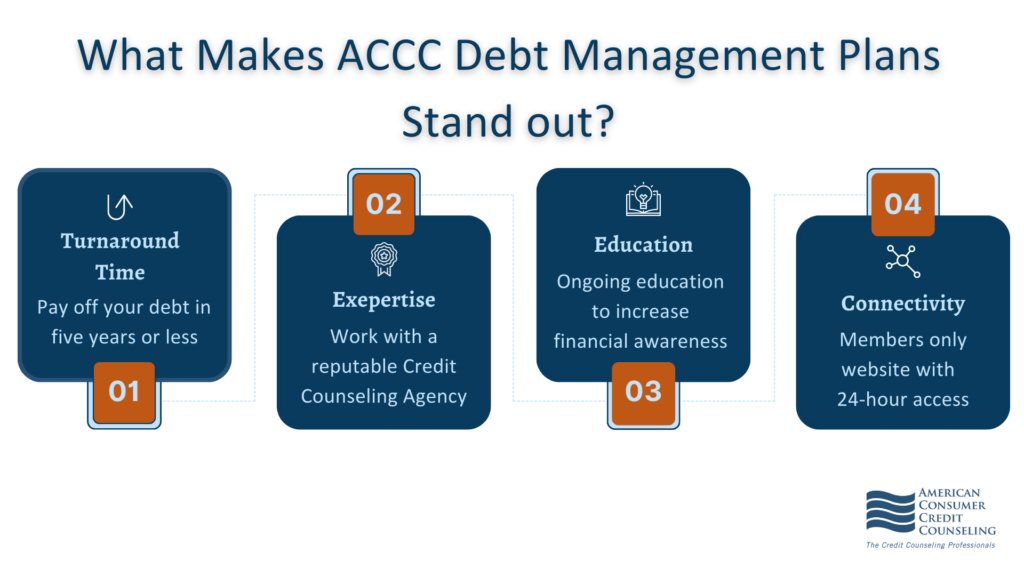

Professional Financial Guidance

Another crucial benefit is the access to professional financial guidance. Debt management programs are typically run by credit counseling agencies staffed with certified counselors. These experts can help you create a budget, offer financial education, and provide ongoing support throughout the duration of your program.

Potential Credit Score Improvement

Though debt management programs themselves do not directly improve your credit score, they can contribute to better credit health over time. As you make consistent, on-time payments and reduce your overall debt, your credit score can improve. This sets you up for better financial opportunities in the future.

Reduced Financial Stress

Managing debt can be extremely stressful, and the constant worry about missing payments or dealing with creditors can take a toll on your mental health. With a debt management program, you can alleviate this stress by knowing you have a clear plan in place for paying off your debt. This peace of mind can have a positive impact on your overall well-being.

How Debt Management Programs Work – The Process Explained

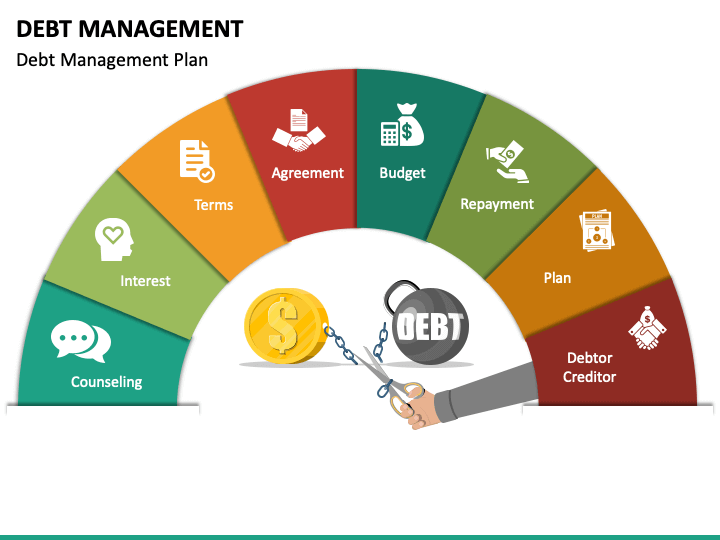

Debt management programs serve as a middle-ground, facilitating a mutually beneficial arrangement between individuals in debt and their creditors. Here’s how the process typically works:

Initial Consultation

The first step in a debt management program is the initial consultation with a credit counselor. During this session, the counselor will review your financial situation, including your income, expenses, and total debt. This comprehensive analysis helps the counselor understand your specific needs and challenges, ensuring that the program is tailored to your situation. You’ll also discuss your financial goals and any concerns you may have about the program.

Creating a Customized Plan

After the initial consultation, the credit counselor will work with you to create a customized debt management plan. This plan outlines your new monthly payment, which is designed to be affordable based on your budget. The plan also includes strategies for managing your expenses and may offer recommendations for cutting costs or increasing income to help you stay on track.

Negotiating with Creditors

Once your debt management plan is finalized, the credit counseling agency will begin negotiating with your creditors on your behalf. The goal of these negotiations is to secure lower interest rates, waive fees, and potentially extend payment terms to make your debt more manageable. Creditors often agree to these concessions because they are receiving consistent, reliable payments through the program.

Making Payments

With the agreements in place, you’ll start making one monthly payment to the debt management company. The company then distributes these funds to your various creditors according to the negotiated terms. It’s crucial to make these payments on time each month to ensure the success of your debt management program.

Ongoing Support and Education

Throughout the duration of your program, you will have access to ongoing support from your credit counselor. This can include regular check-ins to monitor your progress, financial education resources to improve your money management skills, and assistance with any issues that may arise. The goal is not only to help you pay off your current debt but also to empower you with the knowledge and skills to maintain financial health in the future.

Completing the Program

Most debt management programs take three to five years to complete, depending on the amount of debt and your ability to make consistent payments. As you approach the end of the program, your credit counselor will help you transition out of the program and continue managing your finances independently. Successfully completing a debt management program can provide a significant sense of accomplishment and financial freedom.

Steps to Enroll in a Debt Management Program

Enrolling in a debt management program can be a straightforward process if you follow these key steps:

1. Research Credit Counseling Agencies

The first step is to research and select a reputable credit counseling agency. Look for agencies accredited by organizations such as the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA). Reading reviews and checking for any complaints with the Better Business Bureau can also help ensure you choose a trustworthy agency.

2. Schedule an Initial Consultation

Once you have identified a suitable credit counseling agency, schedule an initial consultation. This session is usually free of charge and provides an opportunity for the credit counselor to evaluate your financial situation. Be prepared to discuss your income, expenses, debts, and financial goals in detail.

3. Evaluate the Proposed Plan

After the initial consultation, the credit counselor will craft a debt management plan tailored to your needs. Carefully review this plan, considering the monthly payment amount, the timeline for debt repayment, and any changes in your creditor agreements. Make sure the plan is realistic and manageable for your budget.

4. Sign the Agreement

If you are satisfied with the proposed debt management plan, you will need to sign an agreement with the credit counseling agency. This agreement outlines the terms and conditions of the program, including any associated fees. Understand these terms fully before committing.

5. Inform Your Creditors

Once you’ve enrolled in the program, the credit counseling agency will contact your creditors to inform them of your participation and negotiate any necessary changes to your repayment terms. This step solidifies the framework of your debt management plan.

6. Begin Making Payments

Start making your consolidated monthly payments to the credit counseling agency. They will handle distributing these funds to your creditors as per the negotiated terms. Consistency is key; make sure to make your payments on time each month.

7. Monitor Your Progress

Throughout your participation in the program, keep track of your progress. Regularly review statements from your credit counseling agency and creditors to ensure payments are being applied correctly. Stay in contact with your credit counselor for any adjustments or advice needed.

8. Complete the Program

After completing your debt management program, which typically takes several years, work on maintaining your financial health. Continue practicing good financial habits such as budgeting, saving, and mindful spending to prevent future debt problems.

Successful enrollment and completion of a debt management program can mark the beginning of a healthier financial future, free from the burdens of overwhelming debt.

Success Stories – Real People, Real Results

John’s Journey to Financial Freedom

John found himself grappling with the weight of substantial credit card debt after a period of unemployment. Despite gaining new employment, his income was insufficient to keep up with the mounting interest and fees. Feeling overwhelmed, John turned to a reputable credit counseling agency for help. After his initial consultation, John enrolled in a debt management program tailored to his financial situation. Through consistent monthly payments and the support of his credit counselor, John successfully paid off his debt in four years. Today, John continues to use the money management skills he acquired through the program to maintain a stable and debt-free financial life.

Maria’s Debt-Free Milestone

Maria’s story is one of determination and resilience. Following an unexpected medical emergency, Maria accumulated extensive medical bills that strained her budget. Struggling to balance her financial responsibilities, Maria decided to explore a debt management program. With the guidance of her credit counselor, Maria learned how to better manage her finances and make the most of her income. Over five years, Maria steadily reduced her debt, ultimately paying off all her creditors. Completing the debt management program gave Maria a renewed sense of control over her finances and confidence in her ability to handle future challenges.

A Couple’s Path to Prosperity

Sarah and Mike, a young couple, faced financial difficulties early in their marriage due to student loans and credit card debt. Determined not to let debt overshadow their future, they sought assistance from a credit counseling agency. By enrolling in a debt management program, Sarah and Mike were able to consolidate their payments, negotiate lower interest rates, and establish a practical budget. Over the course of three years, they worked diligently to pay down their debt while receiving ongoing support and education from their counselor. Their perseverance paid off, and they now enjoy financial stability and peace of mind.

Your Success Story Awaits

These success stories illustrate the transformative potential of debt management programs. Through discipline, guidance, and commitment, individuals can conquer their debt and achieve lasting financial well-being. If you find yourself weighed down by debt, remember that help is available, and your journey to a debt-free future can begin today. Take the first step by reaching out to a credit counseling agency and exploring the options available to you. Your success story could be the next one to inspire others.

Conclusion – Taking the First Step Towards Financial Freedom

Taking the first step towards financial freedom can be daunting, but it’s a crucial move that sets the tone for your financial future. It’s important to remember that you are not alone in this journey – many have faced similar challenges and successfully navigated their way out of debt with the help of a credit counseling program. Start by addressing your debt head-on, educating yourself about your options, and making a commitment to follow through with your debt management plan.

The first step is always the hardest, but by seeking guidance and support, you set yourself up for success. Remember, financial freedom is not an overnight achievement; it requires patience, discipline, and determination. Celebrate each milestone, no matter how small, along your journey. These small victories will keep you motivated and remind you of how far you’ve come.

In the end, the skills and knowledge you gain through this process will empower you to make informed financial decisions, avoid future pitfalls, and build a stable and prosperous future. Take control of your finances today and embark on the path to a debt-free life. Your future self will thank you.

Additional Resources: For further information and support, consider exploring the following resources:

- National Foundation for Credit Counseling (NFCC): The NFCC offers a wealth of information on financial education, budgeting tips, and access to certified credit counselors.

- Federal Trade Commission (FTC): The FTC provides valuable insights and advice on avoiding debt-related scams and understanding your rights.

- Debt Reduction Calculator: Utilize online calculators to estimate your debt repayment timelines and strategize your debt reduction plan.

- Financial Literacy Workshops: Attend workshops and seminars in your community to enhance your financial literacy and network with others who share similar goals.

Embrace the journey towards financial freedom with confidence, knowing that resources and support are available to guide you every step of the way.